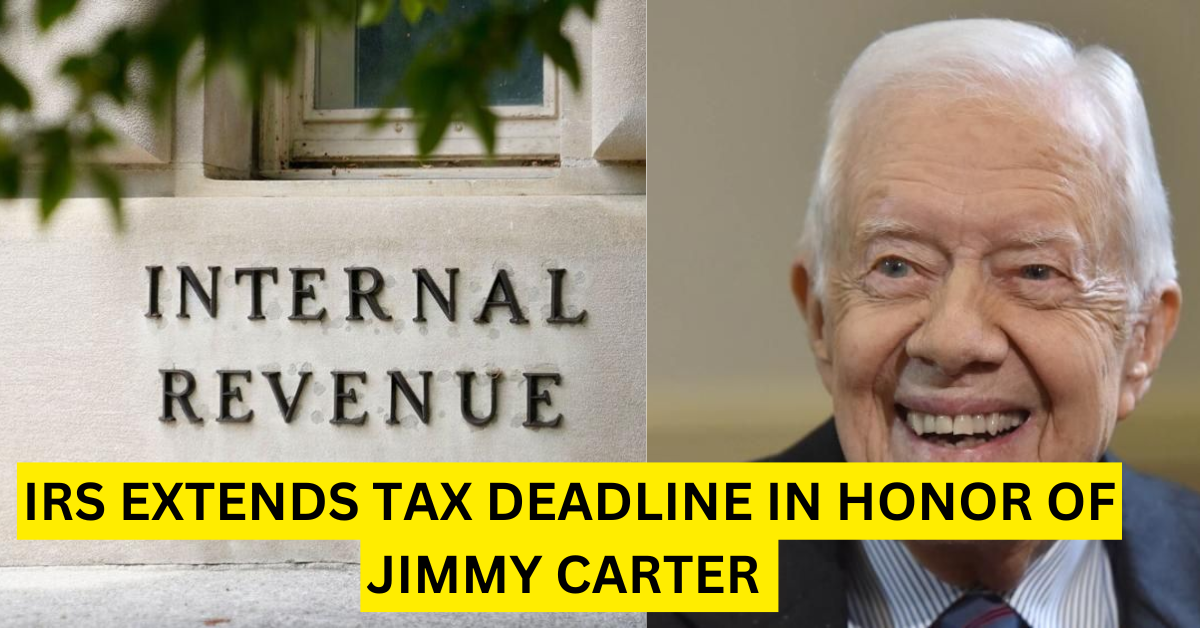

The Internal Revenue Service (IRS) has extended the tax filing and payment deadline due to President Joe Biden’s recent proclamation. January 9, 2025, has been designated as a national day of remembrance in honor of the late former U.S. President Jimmy Carter, who passed away on December 29, 2024, at the age of 100.

Why the Extension Matters

Missing a tax deadline can lead to financial penalties. The IRS imposes a Failure to File penalty, which is 5% of the unpaid taxes for each month or partial month that the return is late, up to a maximum of 25%. This extension provides taxpayers with an extra day to avoid such penalties.

New Deadline Details

The updated deadline for taxpayers to file returns or make payments originally due on January 9, 2025, has been moved to Friday, January 10, 2025. This applies to various tax obligations, including:

- Federal income tax filings.

- Payroll tax deposits.

- Excise tax payments.

The extension covers payments made through the Treasury Department’s Electronic Federal Tax Payment System (EFTPS), ensuring individuals and businesses have enough time to meet their obligations.

Background on Jimmy Carter Remembrance Day

On December 29, 2024, President Biden issued a proclamation declaring January 9 as a national day of mourning for Jimmy Carter, the 39th President of the United States, who served from 1977 to 1981. As part of this observance:

- All federal government departments and agencies will close on January 9, except those essential for national security, defense, or public needs.

- A state funeral for Jimmy Carter is being held at the Washington National Cathedral, marking the legacy of his contributions to the country.

While January 9 typically does not coincide with any major tax deadlines, the extension acknowledges the importance of this day and provides taxpayers with flexibility.

What Taxpayers Should Do

If you have taxes due on January 9, take note of the new January 10 deadline. Whether you’re filing your returns, making payments, or submitting deposits through EFTPS, ensure all transactions are completed by the updated date to avoid penalties or complications.

Conclusion

This extension reflects the nation’s respect for Jimmy Carter’s contributions and ensures taxpayers have the necessary time to fulfill their obligations. Take advantage of the additional day if your taxes fall under this timeline.

This article has been carefully fact-checked by our editorial team to ensure accuracy and eliminate any misleading information. We are committed to maintaining the highest standards of integrity in our content.

Filza specializes in simplifying financial topics for everyday readers. Whether breaking down Canada’s tax guides or U.S. benefits like SNAP and VA Disability, Filza’s relatable writing style ensures readers feel confident and informed. Follow her insights on LinkedIn or reach out via email at shewrites.health@gmail.com.